In today’s world, it’s more important than ever to prepare for your financial future.

And one of the easiest ways to add to your nest-egg is to simply cut expenses and save more of your hard earned money.

We often forget some of the golden rules to saving that our parents taught us. Here’s a quick list of things you can do to save on bills in 2020. No matter your circumstance, there’s something here that everyone can use like cutting down your mortgage bill, save on utilities, get more for your money at the grocery store, and even get samples of popular products.

1. Check The Insulation in Your Attic – And Install More If Needed.

Important: Proper insulation keeps your home warmer in the winter but also cooler in the summer!

If you have an unfinished attic, pop your head up there and take a look around. You should see insulation up there between the beams, and there should be at least twelve inches of it everywhere (more if you live in the northern part of the United States). Experts suggest an R-Value of R38 to prevent cold/hot air leakage.

2. Automate Your Thermostat & HVAC system

One of the easiest things you can do to instantly start saving money on your heating and cooling bills is to get an automated thermostat. These smart thermostats will learn when you are home and make sure the home is at a comfortable setting during those hours so you’re not cooling the house when no one is around to enjoy it. They also learn when you’re going to be home so they can adjust the temperature before you step in the door to ensure your house is always comfortable!

Last year I replaced all of the thermostats in my house with the Nest learning thermostat. It learns your schedule to keep your home comfortable when you are home.

3. Cancel Unused Subscriptions

It’s easier than ever to rack up monthly subscription bills since many products and services nowadays offer monthly plans. But the problem with those is that you sign up and forget. Or you get “cancel remorse” and keep subscriptions that you really don’t use.

Go through your bank and credit card statements and review your subscriptions immediately!

4. Make A Grocery List

You ever go to the grocery store when you’re hungry and find yourself checking out with way more than you intended? We call this “Hunger Shopping” and it’s quite dangerous to your wallet!

Before going to get groceries, make a list of groceries that you need for the upcoming week. That way, you only buy what you’re intending to use and the amount that will get thrown away from being expired is kept to a minimal.

5. Buy in Bulk

One of the easiest things you can do to instantly start saving money is to buy in bulk! Retailers often give a MUCH better deal on products such as paper towel, toilet paper, detergent, etc if you buy in bulk.

This might seem like an obvious one, but we often forget how much money we waste by not buying in bulk.

6. Eat Out With These Top Restaurant Deals

Eating out often can be expensive. But going out to eat for a date night every now and then is totally fine and can be done on the cheap if you choose your restaurants wisely!

Consider these special deals when picking where to go:

Chili’s Three for Me $10 Meals

Choose an appetizer, entree AND desert for just $10

Outback Steakhouse’s Waslkabout Wednesdays for $9.99

Choose steak or chicken with fries AND a drink for just $9.99

Applebee’s 2 for $20

Choose between two salads (or one appetizer) as well as two main meals with sides for just $20

Olive Garden’s Unlimited Soup, Salad, and Breadsticks

Choose between ANY entree at Olive Garden and get unlimited soup or salad and breadsticks. Or you could just do the $6.99 option of unlimited Soup/Salad and Breadsticks.

7. Take Full Advantage Of These Tax Deductions

Owning a home can be very lucrative. Seriously, owning a home can not only give you a cheaper monthly payment than renting but in many cases, the tax benefits make the decision a no-brainer.

Here are a few of the larger deductions that you need to be sure to take:

Interest you pay on your mortgage: If you own a home and don’t have a mortgage greater than $750,000, you can deduct the interest you pay on the loan. This is one of the biggest benefits to owning a home versus renting–as you could get massive deductions at tax time. The limit used to be $1 million, but the Tax Cuts and Jobs Act of 2017 (TCJA) reduced the limit and made some clarifications on deducting interest from a home equity line of credit.

Property taxes: Another awesome benefit to owning a home is the ability to deduct your property taxes. Before TCJA, the rules were a little more flexible and you were able to deduct the entirety of your property taxes. Now things have a changed a bit. Under the new law, you can deduct up to $10,000. The deduction for state and local income taxes was combined with the deduction for state and local property taxes, too.

Tax incentives for energy-efficient upgrades: While most of the tax incentives for making energy-efficient upgrades to your home have gone away, there are still a couple worth noting. You can still claim tax deductions on solar energy–both for electric and water heating equipment, through 2021. The longer you wait, though, the less money you’ll get back. Here’s the percentage of equipment you can deduct, based on time of installation:

Between January 1, 2017, and December 31, 2019 – 30% of the expenditures are eligible for the credit

Between January 1, 2020, and December 31, 2020 – 26%

Between January 1, 2021, and December 31, 2021 – 22%

8. Get Out Of Debt Fast

If you owe more than $20,000 in credit card debt, this proven debt relief program may reduce the amount you owe. Consumers could resolve their debts with absolutely no loan required and get out of debt at a rapid pace. If you’ve struggled to pay your credit card debt, take advantage of this offer before your debt snowballs.

9. Change ALL Your Air Filters

Replace the air filter(s) in your HVAC (heating, ventilation and air conditioning) system, to keep it running more efficiently.

Old filters have reduced air flow forcing your equipment to work harder. This causes parts like fans and blowers to wear faster, especially after a cold winter. A $10 filter can save you thousands on repair costs!

10. Grill!

Here’s an easy money-saving tip: Grill in the summertime! When you use your stove or oven to cook, it creates a lot of heat. And in the summertime, it can make your air conditioner work extra hard. If you’re not much of a griller, consider cooking meals in a crockpot.

Here’s a cheap tasty burger recipe we recommend.

Ingredients

- 1 egg

- 1/2 teaspoon salt

- 1/2 teaspoon ground black pepper

- 1 pound ground beef

- 1/2 cup fine dry bread crumbs

Cooking Instructions

- Preheat an outdoor grill for high heat and lightly oil grate.

- In a medium bowl, whisk together egg, salt and pepper. Place ground beef and bread crumbs into the mixture. With hands or a fork, mix until well blended. Form into 4 patties approximately 3/4 inch thick.

- Place patties on the prepared grill. Cover and cook 6 to 8 minutes per side, or to desired doneness.

11. No Life Insurance? You’ll Want To Use This Brilliant Life Insurance Trick

If you don’t have life insurance, you better read this.

It’s not something any of us like to think about or plan for. But when the worst happens, it’s essential to know your family and loved ones are covered financially. That’s why it’s essential to have a life insurance. A good life insurance policy can help cover the cost of a mortgage, childcare costs and safeguard your family from inheriting any debts you might have.

But the sad truth is, a shocking number of Americans do not have a life insurance policy and their family is at financial risk if the worst should happen.

There is a service that is now allowing users to get free life insurance quotes from some of the top insurance companies out there. People are shocked at how cheap an excellent policy is after requesting their free quotes. But the reality is, life insurance rates are at a 20-year low and thanks to new program policies you could qualify for a great new policy at an extremely affordable price.

To get your free quote today, click below and complete a few questions (about 60 seconds). Once you’re done, you will be presented with choices and rates you never thought possible (no login required). Enjoy your savings! Get Your Free Quote Now >>

12. Never Pay Out-of-Pocket For Home Repairs Again

Homeowners know better than anybody: if it can go wrong it will go wrong. When purchasing new construction, buyers are often given an option to purchase a home warranty that covers home repairs on everything from microwaves to roofs. What many people don’t know is that almost any homeowner is eligible to get a home warranty for their existing homes. Think of it as insurance for the things that break all the time in your home.

13. Quit Buying Expensive Coffee

Yes, we all love a tasty Starbucks latte every now and then. But buying coffee from your favorite barista everyday adds up quick!

Let’s do the math… $5 per latte 5 days a week is $25 a week. That’s $100 per month just for coffee!

If you brew your own coffee at home, the cost is around 30 cents a cup. Now if you’re all about convenience, consider a Keurig Coffeemaker. The cost per cup will go up to around 60 cents but it’s still MUCH cheaper than buying from a coffee shop and is super convenient.

14. Car Insurance As Low As $19 Is Possible With New Policy

Here’s what auto insurance companies don’t want you to know…and what thousands of consumers are quickly learning about their current auto insurance plan:

If you’re paying more than $63 per month for auto insurance, this auto insurance comparison tool can help you check to see if you’re overpaying in a few minutes. This is something every driver should be doing every 6 months or so to ensure that they are getting the best deal.

Insurance companies are always competing to win your business, but if you turn a blind eye and keep the same policy in place for a long period of time, your rates might have increased. By checking rates, drivers saved an average of $531 per year with a new policy.

So do yourself a favor and do a quick comparison by filling out a short form (about 4 minutes). This is a fast way you can start saving on your auto bills.

15. Parents Can Get Health Insurance For $9/Month

Health Insurance is now available to more Americans than ever before. In the past, many paople took the risk of not being insured, but with the Affordable Care Act (ACA) you can be fined if you don’t have health care insurance.

Instead of paying a fine, people who have not been able to afford insurance before are looking for affordable medical insurance options. Whether you have low, mid, or high income, you could greatly reduce your health insurance by using HealthQuotes to compare policies and prices, and find what’s best for you.

16. Born Before 1985? Get $3,000/year Off Your Mortgage With The Lucrative Government Sponsored “HiRO” Program

Banks Don’t Want Homeowners Knowing This

Still unknown to many is a brilliant Government sponsored program called the High LTV Refinance Option (HiRO) that could benefit millions of Americans and reduce their payments by as much as $3,000 per year! You could bet the banks aren’t too thrilled about losing all that profit and might secretly hope homeowners don’t find out before the rules change.

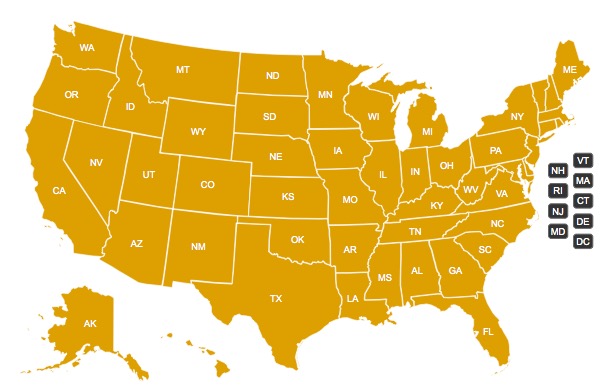

So while the banks happily wait for this program to end, experts are making a nationwide push and urging homeowners to take advantage. This program is currently active as of 2020, but the rules could change soon. But the good news is that once you’re in, you’re in. If lowering your payments, paying off your mortgage faster, and even taking some cash out would help you, it’s vital you act now and see if you could qualify for HiRO or a better rate in today’s marketplace.URGENT: So many homeowners could still benefit today, but sadly, many perceive HiRO to be too good to be true. Remember, HiRO is a free program and there’s absolutely NO COST to see if you qualify. See if you qualify now to reduce your monthly payments >>

How Do I Qualify?

Step 1: Click your state on the map to instantly check your eligibility for free.

Step 2: View your new lower rate and save money! Click here to see your new low rate.

Select Your State:

“BONUS TIP” : Veterans Get a Massive Discount at Lowes

All active military and veterans are entitled to get a 10% discount on all in-store purchases at Lowe’s.

To make it even better, Lowe’s extends this offer to their spouses! Need new tools? How about new appliances? Lowe’s carries a variety of things, so take advantage of this incredible discount!